Effective Internal Control Over Cash Includes the Requirement That

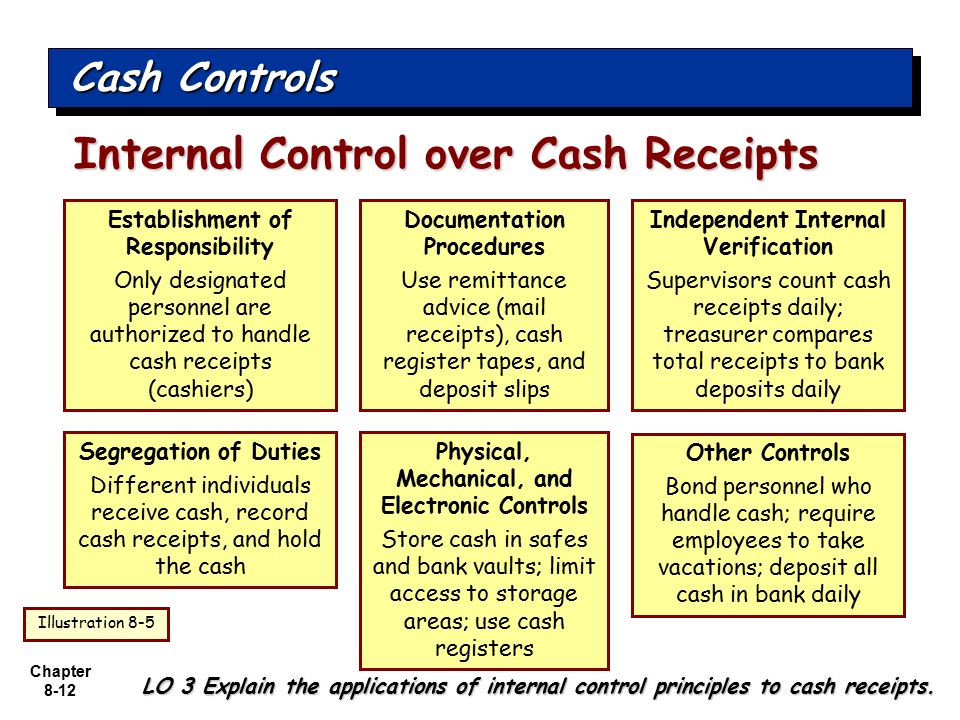

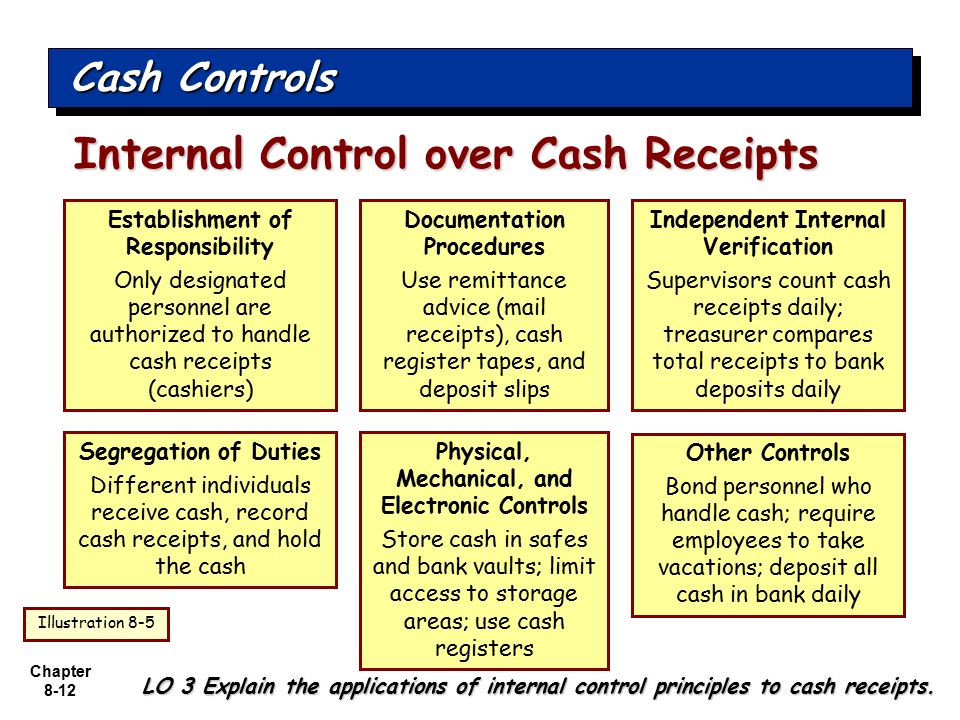

Standard physical internal controls for safeguarding assets include unique passcodes for cashiers at cash registers and key cards for warehouse employees. Internal control over financial reporting as such term is defined in Rule 13a - 15f and Rule 15d - 15f of the Securities.

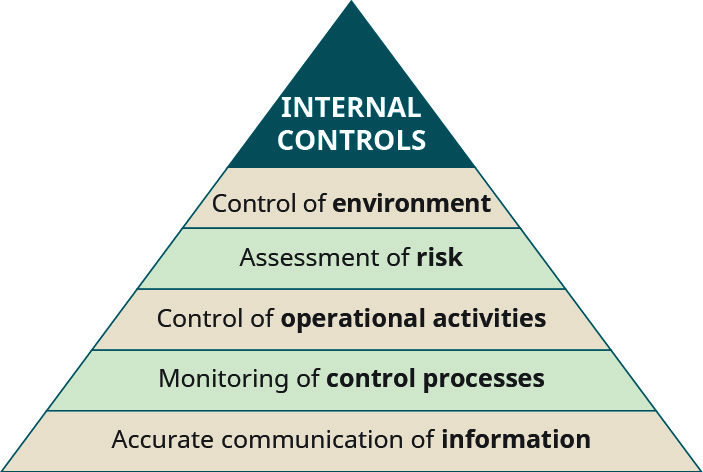

Define And Explain Internal Controls And Their Purpose Within An Organization Principles Of Accounting Volume 1 Financial Accounting

Of all the assets cash is the easiest to misappropriate.

. No individual is to have complete control in the handling of cash. What Internal Controls Are Needed for Cash Disbursement. Material misstatements an effective system of internal control over financial reporting ICFR can substantially reduce the risk of such misstatements in a companys financial statements.

Should have had. Incoming cash must be made a matter of record as soon as possible. You will want to develop policies regarding who in your organization can.

The need to control cash is clearly evident and has many aspects. Then the Internal Controls are not effective. Cash controlling receipts and cash disbursements reduces erroneous payments theft and fraud.

2 provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in. Authorization and Processing of Disbursements. C The person who makes deposits should NOT record the deposits.

Small businesses are the most vulnerable to fraud because they often dont have effective internal controls. Using either will help achieve your objectives related to operations reporting and compliance. A dual signature policy includes the establishment of a dollar threshold over which checks require two signatures.

The non-Federal entity must. Segregation of duties means that no financial transaction is handled by only one person from. No one had a job title.

Cash control is cash management and internal control over cash and cash-related policies within a company. Effective internal control system. D a and b.

A Establish and maintain effective internal control over the Federal award that provides reasonable assurance that the non-Federal entity is managing the Federal award in compliance with Federal statutes regulations and the terms and conditions of the Federal awardThese internal controls should be in compliance with guidance in Standards for. Effective internal controls for cash prevent the proverbial hand in the cookie jar. Specifically no one individuals duties should include the actual handling of money recording receipt of money and the reconciliation of bank accounts or with the state treasurer.

Effective internal control over cash includes the requirement that. Your company may also want to consider the use of dual signatures as a further internal control for cash disbursements. If your grant or subgrant is subject to the uniform administrative requirements of 2 Code of Federal Regulations CFR Part 200 then 2 CFR 200303 requires that your organization follow.

August 2019 Internal Control PART 6 - INTERNAL CONTROL The focus of this part is on internal control over compliance requirements for Federal awards sometimes referred to as internal control over compliance. Restrictively endorse checks immediately upon receipt stating For Deposit Only Syracuse University. Companies protect their assets by 1 segregating employee duties 2 assigning specific duties to each employee 3 rotating employee job assignments and 4 using mechanical devices.

They protect both the University and the employees handling the cash. CASH DISBURSEMENT CONTROLS Generally internal control over cash disbursements is more effective when companies pay by check or electronic funds transfer EFT rather than by cash. It is intended for the consideration of both non-Federal entities and auditors and includes the following.

Effective Internal Controls for Cash All businesses should have internal controls to deter fraud detect theft and preserve assets. Internal control includes corporate governance company policies segregation of duties authorized approvals for purchases designated. Fell over partly due to a lack of controls in all areas of the company.

How does a small business develop internal controls for cash. B The same person who makes deposits should also record the deposits. Consider requiring dual signatures.

A companys internal control over financial reporting includes those policies and procedures that 1 pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company. Other controls necessary for financial security include requiring authorized approvals for purchases requiring signature authority and reconciling all payments and bank account activity. Internal cash control systems can include your organizations governance all company policies and segregation of duties within your company.

The person who makes deposits should NOT record deposits The primary reason the balance of cash in the companys records will differ from the balance of cash in the banks records includes. Multiple Choice Only checks are used for payment of purchases. Effective internal control over cash includes the requirement that.

No one had any. Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. The same person who makes deposits should also record the deposits О The person who makes deposits should NOT record the deposits.

There are three categories for reporting internal control weaknesses. Keep cashchecks in a locked and secure area until they can be deposited. Congress codified the requirement that public companies have internal accounting controls in the Foreign Corrupt Practices Act of 1977 FCPA.

A network of approvals by authorized individuals acting independently to ensure that all disbursements by check are proper. Physical assets include cash stock and equipment and non-physical assets could include debtors. Effective internal control over cash includes the requirement that.

Without the proper timing of cash flows and the protection of idle cash a business cannot survive. These physical internal controls may also be digital such as requiring a password to access an organizations network. A Only checks are used for payment of purchases.

Statement of Cash Flows The requirements for calculating and presenting the financial.

Internal Control And Cash Accounting Principles Eighth Edition Ppt Video Online Download

What Are Internal Controls Types Examples Purpose Importance

No comments for "Effective Internal Control Over Cash Includes the Requirement That"

Post a Comment